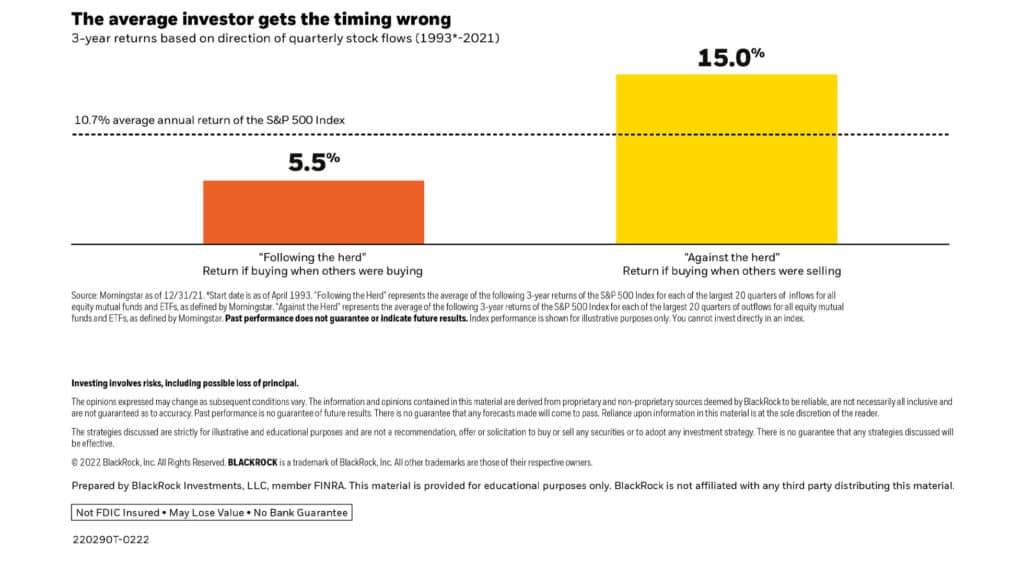

I want to talk to you today about staying invested in the market.

I want to talk to you today about staying invested in the market.

If you miss the top 25 days of the market, you will only have a portfolio worth 134,000. The chart explains the top 5, the top 10, the top 15, and the top 20. You can see the difference in what your portfolio value will be worth.

So I’m not suggesting that you stay invested in bad investments. You know, that’s where if you have a portfolio manager, they should be helping you to rotate out of those bad investments and get into investments making more sense based on the economy and other factors at that time.

So here again, I know it’s easy to say don’t panic or go to cash, especially when you’re going on that roller coaster of a stock market. But as you can tell from this chart, there are some benefits, definite benefits to staying invested.

If you have a portfolio manager actively managing your account, you can transition from asset classes or assets that are performing well with the market, sell those bad or underperforming, underperforming assets off and get into much better performing assets. But the point is to stay invested. Don’t just go to cash or wait six months or a year. Please ensure you’re in the market because you can tell from this chart, and the numbers prove it. You will come out much better ahead in the long term.

So here at Suncoast CPA Group, we have a sister company called Take Point Wealth Management. Eric Arnett is my partner in that company, and we provide those investment services for our clients. So if you have a plan that you want to have us look at, or you don’t have a plan, please see us.

We offer a free planning session or sessions with you to ensure that the plan you have today will get you to where you want to be when you get to retirement, so you don’t run out of money retirement. “Am I going to run out of money in retirement?” many retirees worry. So we can put together a plan to help you avoid that from happening? So please call us at Suncoast CPA Group at 352-596-2883 or reach out to us on our website, Suncoast CPA Group. Thank you.